Latest News

City officials were notified Wednesday that Trumark Homes has sold the former La Puerta Intermediate School property to Taylor Morrison Homes for an unspecified amount. Claremont Unified School District sold the property to Trumark in February for $12.25 million. Taylor Morrison intends to use the same plans for its development, according to city officials. Courier photo/Peter Weinberger

Cindy Cordoba, assistant professor of apparel merchandising and management at Cal Poly Pomona, was recently awarded a $398,926 Extreme Heat and Community Resilience Program grant as part of the state’s Integrated Climate Adaptation and Resiliency Program.

“Life is a carnival,” as the old Band song goes. “Two bits a shot.” Or it’s a parade. Free for the looking. At least it is in Claremont on the Fourth of July.

Claremont Heritage’s Treasury of Claremont Music 2025 summer concert, featuring live music, food and drink, a silent auction, and a recognition ceremony for artists.

“Want to become a U.S. citizen? Up until recently one avenue was to be born here. Another way involves a 100-question oral citizenship test. The first question, under the heading ‘American Government,’ subheading ‘Principles of American Democracy,’ is ‘What is the supreme law of the land?’ The answer, of course, is ‘the Constitution.’ Is it though?”

By Peter Weinberger | pweinberger@claremont-courier.com At the Claremont Courier, we believe deeply in the power of a free press. It’s not just our job — it’s our purpose. And it’s protected by one of the most essential rights we have as Americans: the First Amendment. The First Amendment guarantees freedom of speech, freedom of the […]

Fourth of July in Claremont was once again packed full of traditional fun, with thousands of folks taking part in the city’s annual Independence Day celebrations. Fourth of July staples like the parade, the pancake breakfast, 5k and kids’ run, speaker’s corner, water slides, and the evening fireworks show, above, were part of the day, as well as the “free America” protest up the street on Foothill Boulevard in the afternoon. See our photo coverage inside. Courier photo/Peter Weinberger

The 2025 edition of Claremont’s July Fourth festivities felt a lot like old times, with the morning kicking off with the 5K race and Kiwanis pancake breakfast, followed by cool water games and live music at Memorial Park. Check out the sights from today. Courier photo/Andrew Alonzo.

Claremont Unified School District’s Board of Education voted unanimously to name Diana Taylor as the new principal of Sumner Danbury Elementary and Heather Lyn as assistant principal at El Roble Intermediate at its June 19 meeting. Courier photo/Andrew Alonzo

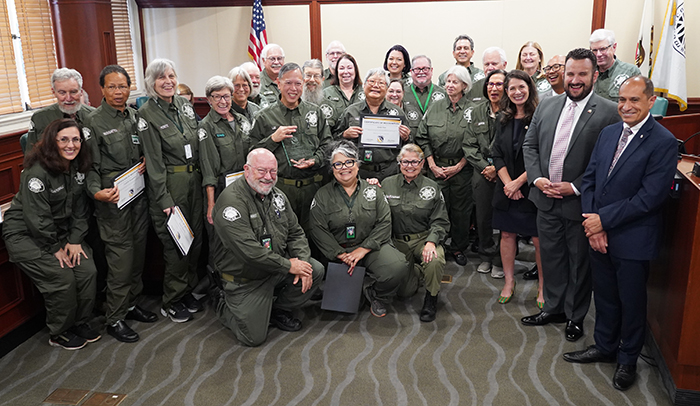

Claremont City Council recognized several Claremont Community Emergency Response Team volunteers that responded to the Eaton Fire in Altadena earlier this year at its June 24 meeting.

Ophelia’s Jump Productions’ “We Will Rock You,” an original musical written by members of Queen and Ben Elton about rock ‘n’ roll in a post-apocalyptic world, opens July 10 at Pomona College’s Sontag Greek Theatre, at 300 E. Bonita Ave., Claremont.

Pitzer College’s summer academic enrichment program, Project Think, with programs for transitional kindergarteners through second graders on language arts, math, science, and social studies, and classes in computers, art, science, creative writing, and theater for children in grades three through eight, run from 8:30 a.m. to noon Monday through Friday. Additional afternoon courses and child […]

At press time, four Claremont Little League All-Star baseball teams remained alive in their respective tournaments, and Claremont’s 10-year-olds are District 20 champions. More scores and our story inside. Photo/courtesy of Claremont Little League